Although the slump in oil prices caused headaches to exporters, the South American countries have faced more destructive economic challenges.

Petrodollar-dependent economic structures have given rise to political crises, as well as economic challenges, for these countries.

This article aims to review oil production status in South American countries, their strategy vis-à-vis the oil price slump and their economic outlook.

Oil in South America

South American countries enjoy a quite important position in oil production in the world. Some of them like Venezuela, Brazil, Ecuador, Argentina and Uruguay are among the top producers of crude oil. South American countries supply a total of 7.3 mb/d.

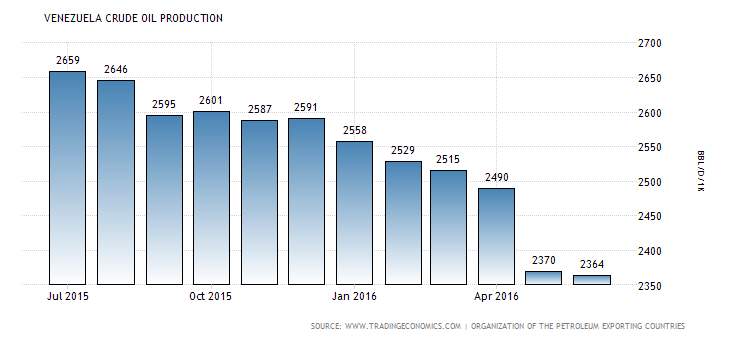

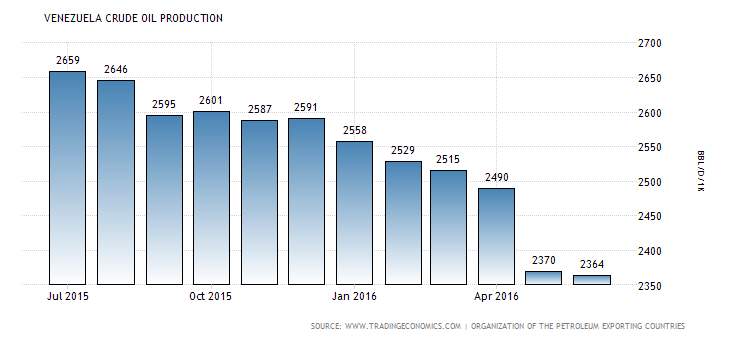

Among countries in this region, Venezuela alone holds 72.1% of oil deposits in Latin America and accounts for 35.7% of the total oil production in this continent. According to official data from the Organization of the Petroleum Exporting Countries (OPEC), Venezuela’s crude oil output declined 9% to 2.364 mb/d during the one year leading to July 2016. Over recent years, Venezuela has seen the sharpest decline in oil production due to economic crisis, insufficient investment, delayed payment to oil service providers, difficult equipment procurement, weak planning for exploration and recovery from massive oil fields in the country.

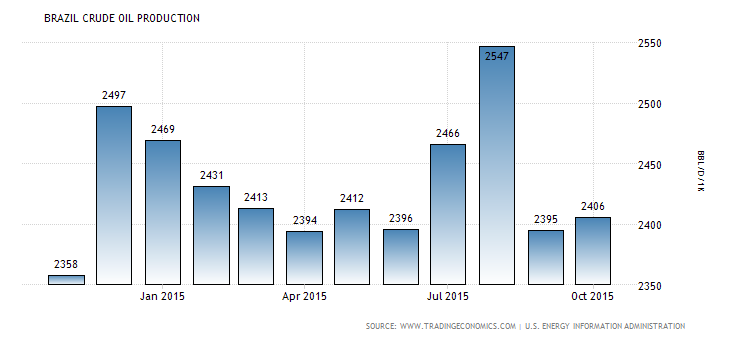

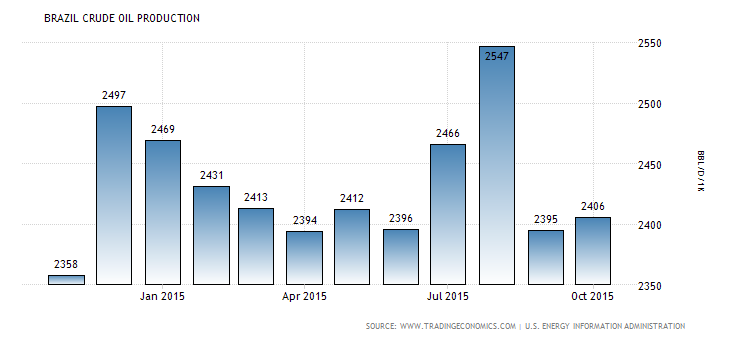

Brazil with 10.8% of Latin America’s oil reserves comes second with a 28.3% share in oil output from the region. Oil reserves in Brazil could make this country one of the biggest players of the oil market in the world in the future. Brazil is also one of the four countries equipped with technology to extract oil from deep waters. The fall in oil prices has dissuaded investment in oil fields and led to the shutdown of reservoirs. That has inflicted losses on the Brazilian petroleum industry. Brazil’s state-run giant Petrobras is among top 20 oil companies in the world. It posted a $10.4 billion loss in 2015, which was unprecedented. In a bid to reduce its debts, supply money and deal with the consequences of oil price slump, Petrobras plans to axe up to 12,000 jobs by 2020.

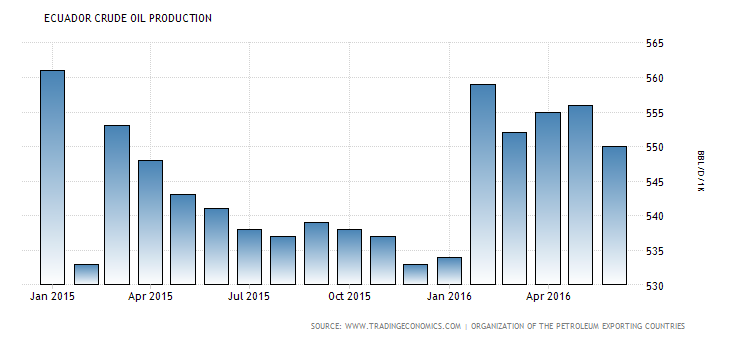

Ecuador is the smallest OPEC member state. It holds 4.4% of South America’s oil reserves and accounts for some 6.9% of oil production in this region. In 2016, with an increase in the ITT oil field reserves estimate, Ecuador’s oil reserves total 4 billion barrels.

Ecuador currently produces some 540,000 b/d of oil. The fall in oil prices in global markets has inflicted heavy losses on Ecuador as an oil seller. Investment in this country has declined, while its debts have been inflated.

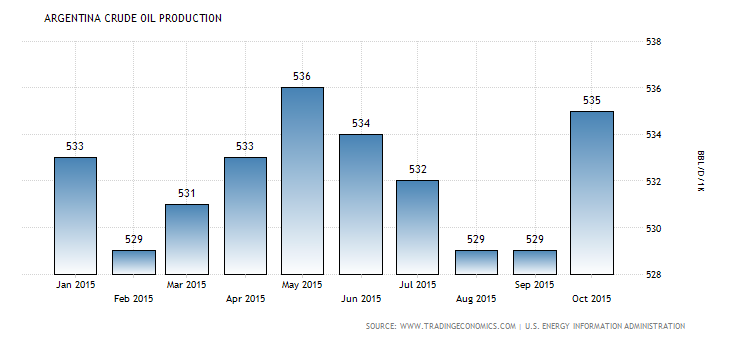

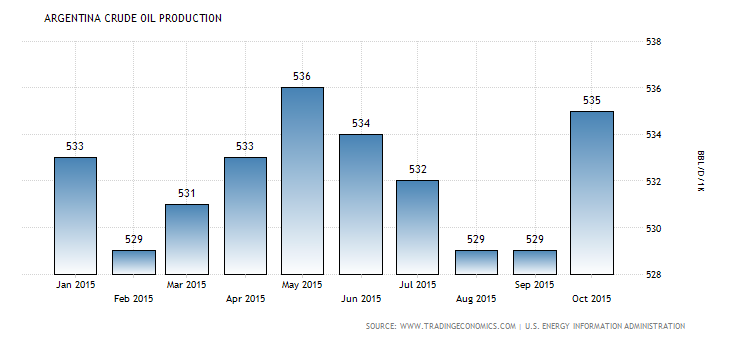

Argentina, which holds 2.2% of Latin America’s oil reserves, produces 9.9% of this region’s oil. Argentina’s petroleum industry has experienced lower production due to lower investment over the past one decade. The global decline in oil prices adds to these negative impacts.

Argentina is currently facing an energy trade deficit and its energy reserves are under pressure. The Argentinean government plans to attract investment into untapped Vaca Muerta field which holds shale oil and shale gas in a bid to change its current conditions. But current low energy prices and uneconomical investment in shale oil have dissuaded big oil companies from investing in Argentina. As long as oil prices remain below $47.5 a barrel the Argentina government has no option but to pay $7.5 in aid per barrel to exporting companies.

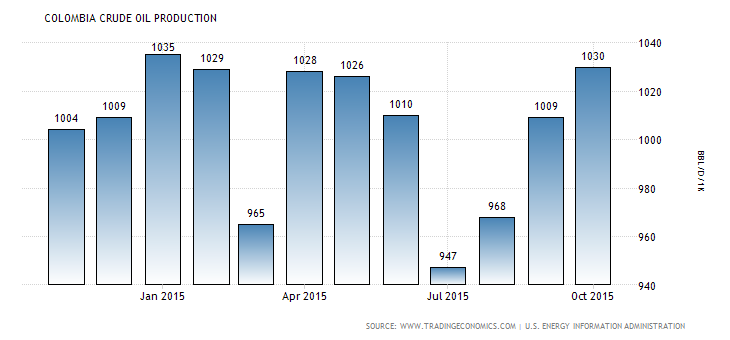

Colombia is the fourth largest oil producer in South America. It accounts for 5.1% of oil reserves in this region. Its average oil production in 2015 reached 1.6 mb/d. Colombia heavily depends on oil revenue and the oil price slump has harmed it deeply. For instance, exploration activities as well as the level of crude oil reserves have declined due to the oil price fall. According to an official report, crude oil reserves in Colombia declined by 13.2% to 2 billion barrels in 2015 from the year before.

Other South American countries like Uruguay, Bolivia, Cuba, Barbados, Chili, Peru, and Trinidad and Tobago either do not have any oil reserves or use their oil for domestic purposes only.

No Common Strategy

The standing and amount of oil exports from South American countries in 2015 indicate that except for Venezuela ranking 9th, other countries are considered small exporters of oil. However, oil exports from these countries largely affect their economies.

Oil Exports in South America, 2015

| Country | Ranking Among Exporters | Exports ($bn) | Share of World Markets (%) |

| Venezuela | 9 | 27.8 | 3.5 |

| Colombia 26 | 17 | 12.8 | 1.6 |

| Brazil | 11.8 | 1.5 | |

| Ecuador | 26 | 6.4 | 0.8 |

| Argentina | 45 | 672.6 | 0.09 |

Therefore, the leading oil exporters in South America are willing to cooperate with top oil producers in the world in a bid to help bring stability back to oil market. But these countries lack any united strategy on this issue.

Although oil exporting countries in South America are in favor of action by OPEC and non-OPEC oil producers for the restoration of stability to crude oil markets in the world, they remain divided about supporting the idea of production freeze or other ideas bandied about in media for a balanced oil price.

For instance, while Venezuela was a firm supporter of oil production freeze, other countries in South America did not favor the plan because on one side crude oil production in these countries has significantly dropped due to decrepit equipment and mature oil reservoirs, while on the other side the sharp decline in oil prices has forced them to raise their production in a bid to make up for their economic losses. Therefore, most South American countries are unwilling to reduce their oil production. Any production hike will boost supply and reduce prices and it could not offer any effective solution for dealing with the economic crises of these countries either.

Future Prospects

According to credit rating firm Moody's Corp., Latin American national oil companies need crude prices to surpass $55 per barrel to break even, a level that would allow them to invest capital enough to start reverting declining output.

Moody's expects credit quality to remain weak for these oil companies through at least mid-2017, with persistent risks that include falling production, short-term debt maturities, asset sales and cost cuts.

The report, which included ratings for 14 companies operating in Latin America or related to national oil companies, says the recent oil price rally will offer "minimal relief" from the stress that the longer-term fall in prices has inflicted.

Crude output in Venezuela, Ecuador, Brazil, Mexico, Argentina and Colombia jointly fell 4.6 percent in the first quarter to 9.13 million barrels per day (bpd), according to official figures. State-run Ecopetrol from Colombia, Petrobras from Brazil and Pemex from Mexico are sharply cutting costs or selling assets, trying to adjust to a lower-price environment.

Generally speaking, the decline in oil price has not only left negative impacts on the operations of oil companies in South America but also it has inflicted irreparable damage on their economies due to much lower revenue from oil sales. This issue takes up added importance when one takes into account the fact that in South American countries oil is intertwined with domestic and foreign politics.

Petrodollars play an important role in survival of governments and politicians in power. The spillover of economic crises to politics in Brazil and Venezuela is a case in point.

Furthermore, the United States has been closely watching developments in Latin American countries and makes efforts to guarantee the survival of its favorable elite in power. That would help US oil companies pocket huge margins while governments in these countries will become further dependent. That is why leftist elite in South America has been at odds with the US, while rightists have been favored by Washington.

Therefore, crude oil plays an important role in relations between oil producing countries in Latin America and the United States. Oil is even instrumental in the survival of political leaders and governments in Latin America.

Courtesy of Iran Petroleum

By Shuaib Bahman

Your Comment